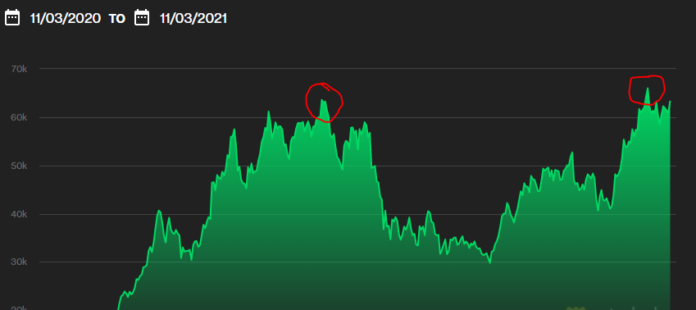

Since hitting its all-time high early this May, Bitcoin (BTC) has failed to make a new high. During this time, a massive cup & handle pattern has formed on the daily chart .

As we can see in the chart above, everyghing is set for a major breakthrough for BTC price. Cup and Handle is a chart pattern that resembles a cup and handle where the cup is in the shape of a “u” and the handle has a slight downward drift. With the latest drip in the BTC price this handle was created.

While large altcoins such as Ethereum and Solana continued to rise on Wednesday and are already marking new highs, Bitcoin is losing more than two percent and thus temporarily falling below the $ 62,000 mark. The analysts at JPMorgan put the fair value of the digital reserve currency even lower.

In a current market outlook, the strategists of the US investment bank write that digital assets, which also include crypto currencies such as Bitcoin, are in a structural upward trend over several years. Although they anticipate that Bitcoin and Co will develop better than the overall market again in 2022, they are not among their investment favorites for 2022.

In my opinion Bitcoin price will have another big run before 2022, which is something we saw in previous years- Price goes up as the end of the year approaches.

If the relative volatility should halve within the next year, however, a target price of $ 73,000 would be “justifiable,” the news agency Bloomberg quotes from the study. The JPMorgan strategists are aware that they are significantly more modest than the crypto analyst, for the “price targets of $ 100,000 and above seem to be the consensus for 2022”.

According to data from the analysis company CoinShares, around two billion dollars in financial products were pumped onto the Bitcoin in October alone. This corresponds to almost a third of the total inflow of funds since the beginning of the year. A large part of this is of course due to the start of trading of the first ETF on the Bitcoin Future on October 19.

The fact that the institutions are still putting money into the market at the most recent highs is a positive signal and testifies to the expectation that prices will continue to rise.